Open

Finance

Suite

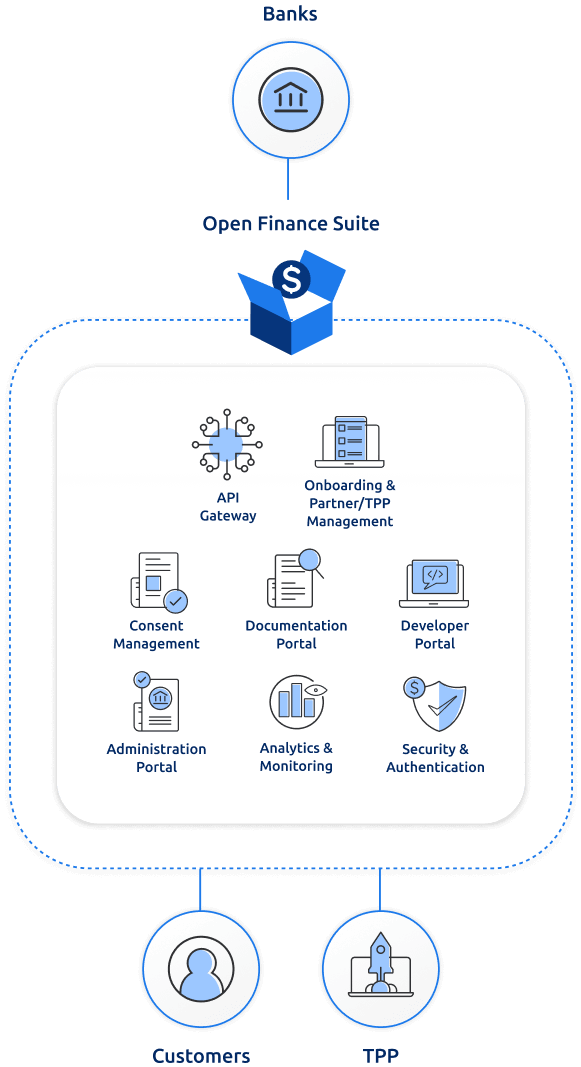

Become open banking compliant on the SaaS platform that builds your APIs to go live in 12 weeks.

Get Started

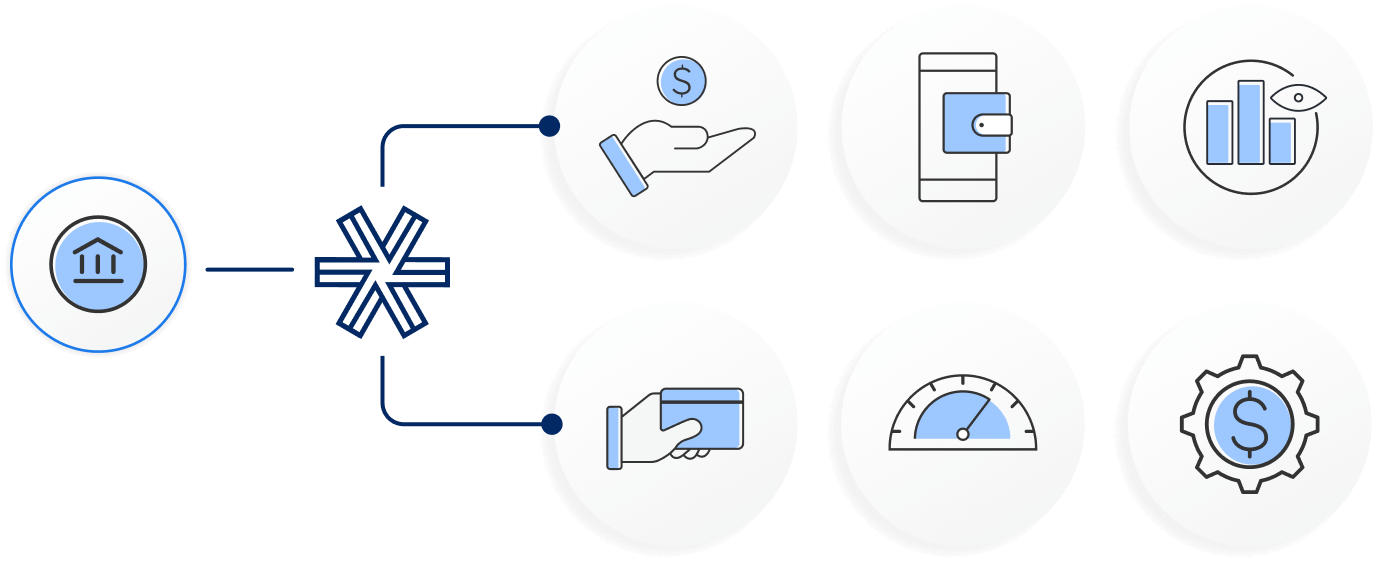

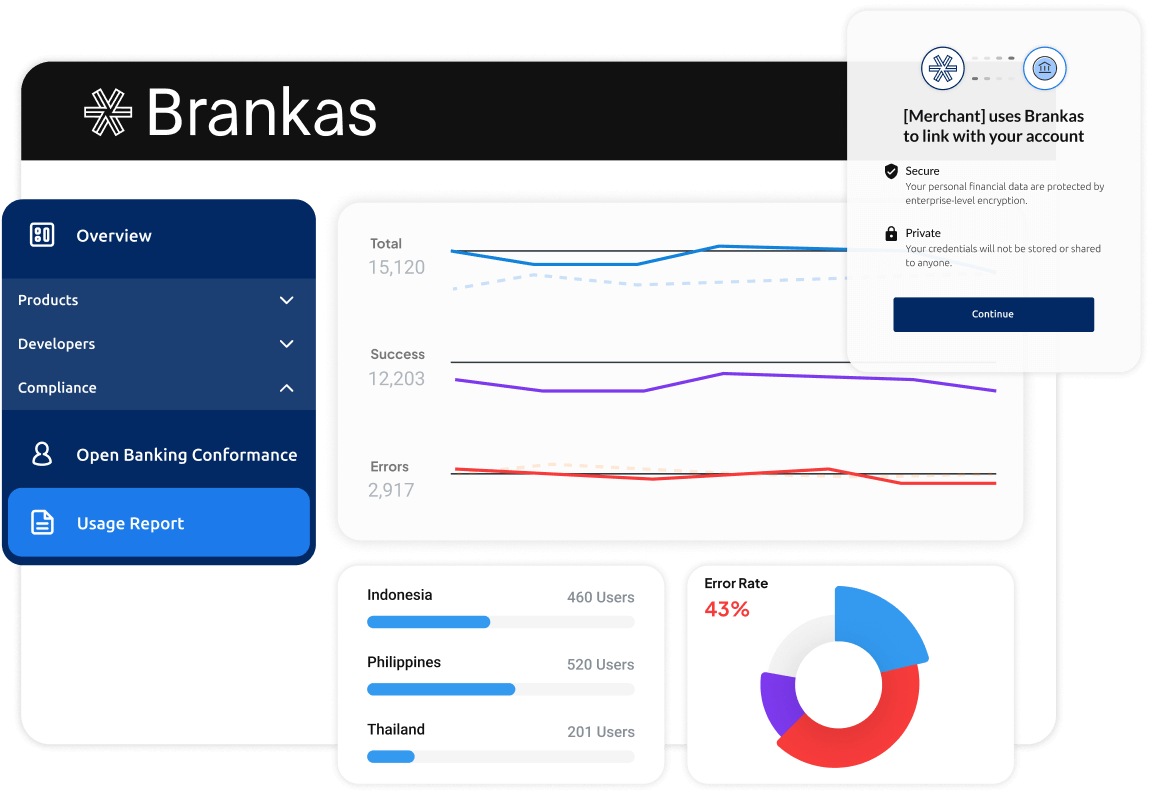

The all-in-one platform for global Open Banking and Open Finance compliance and Banking-as-a-Service (BaaS) enablement.

For cloud, on-premise, and hybrid deployments.

Brankas is compatible with most Core Banking Systems, ensuring easy integration and streamlined functionality.

Get these benefits and features, and more.

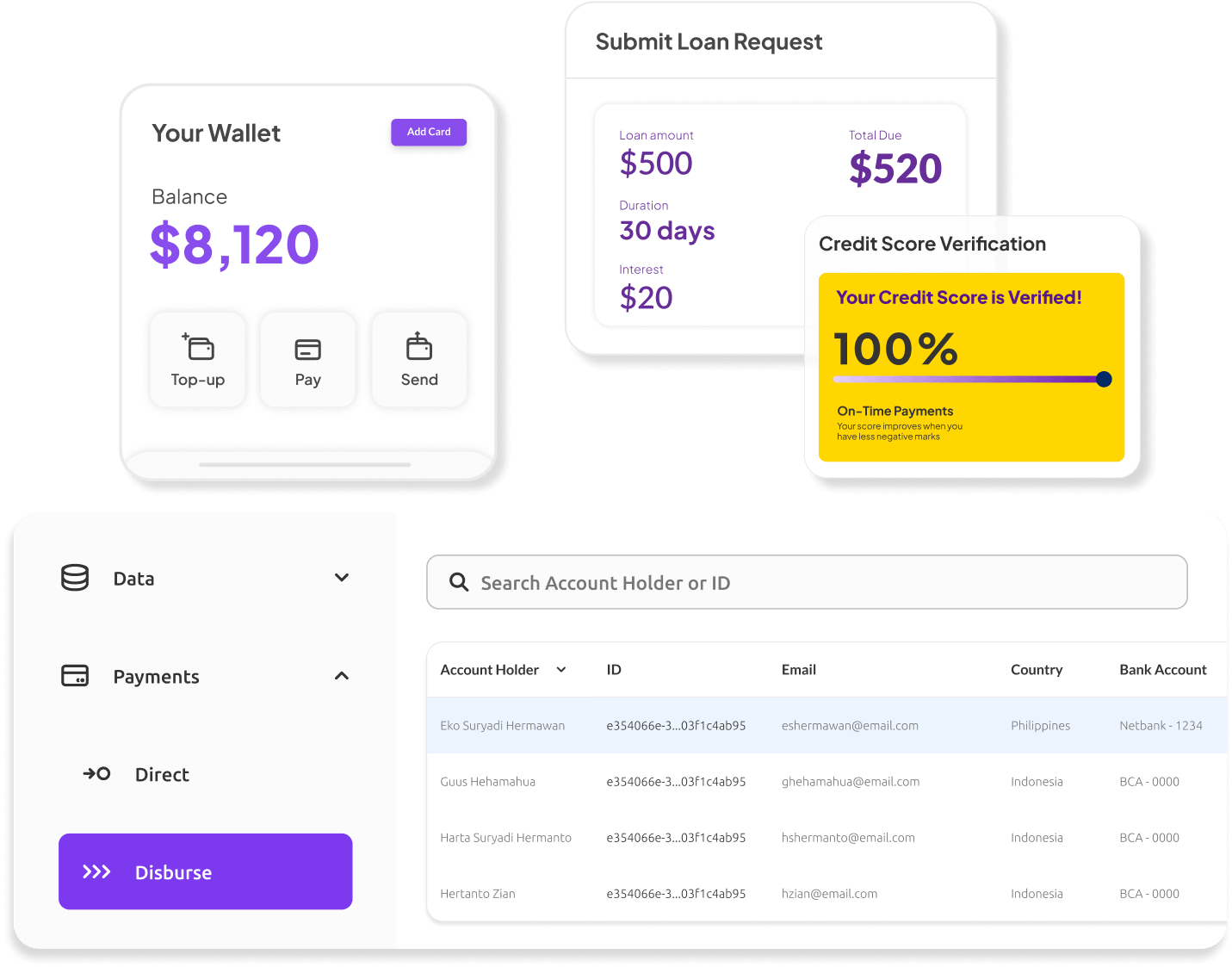

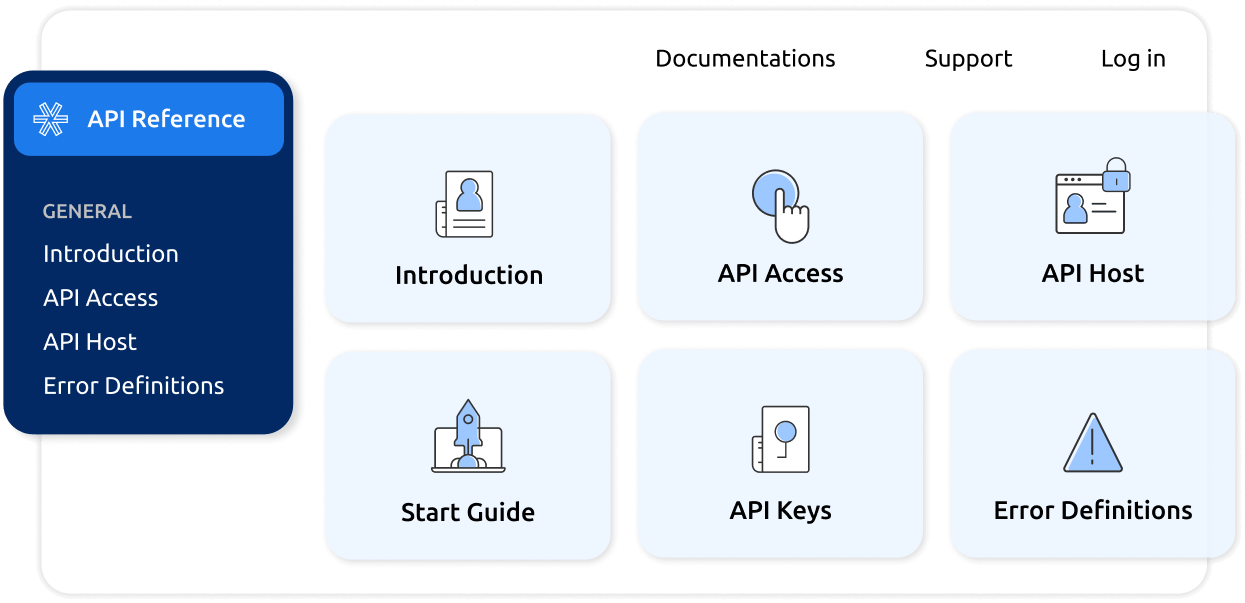

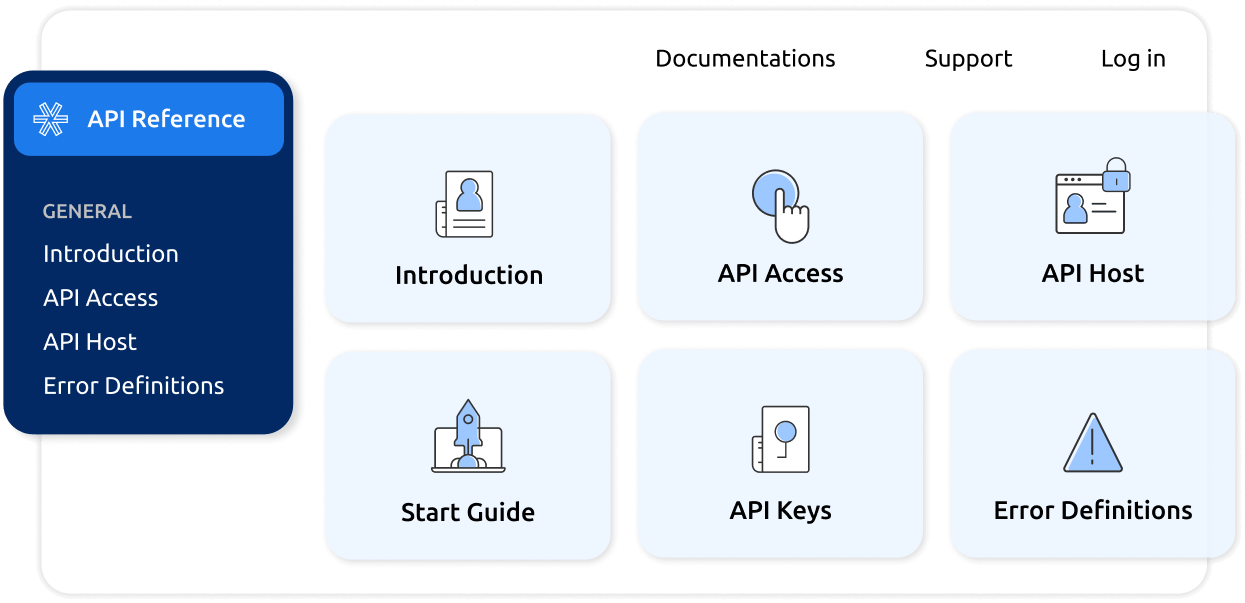

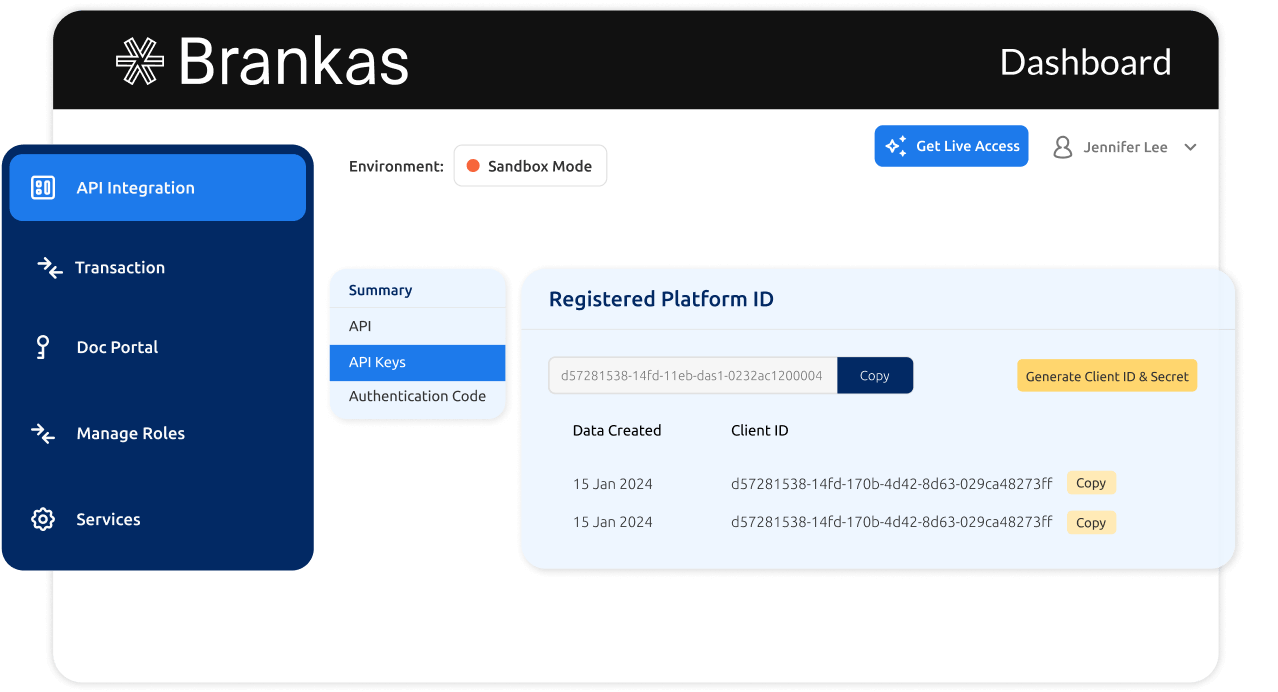

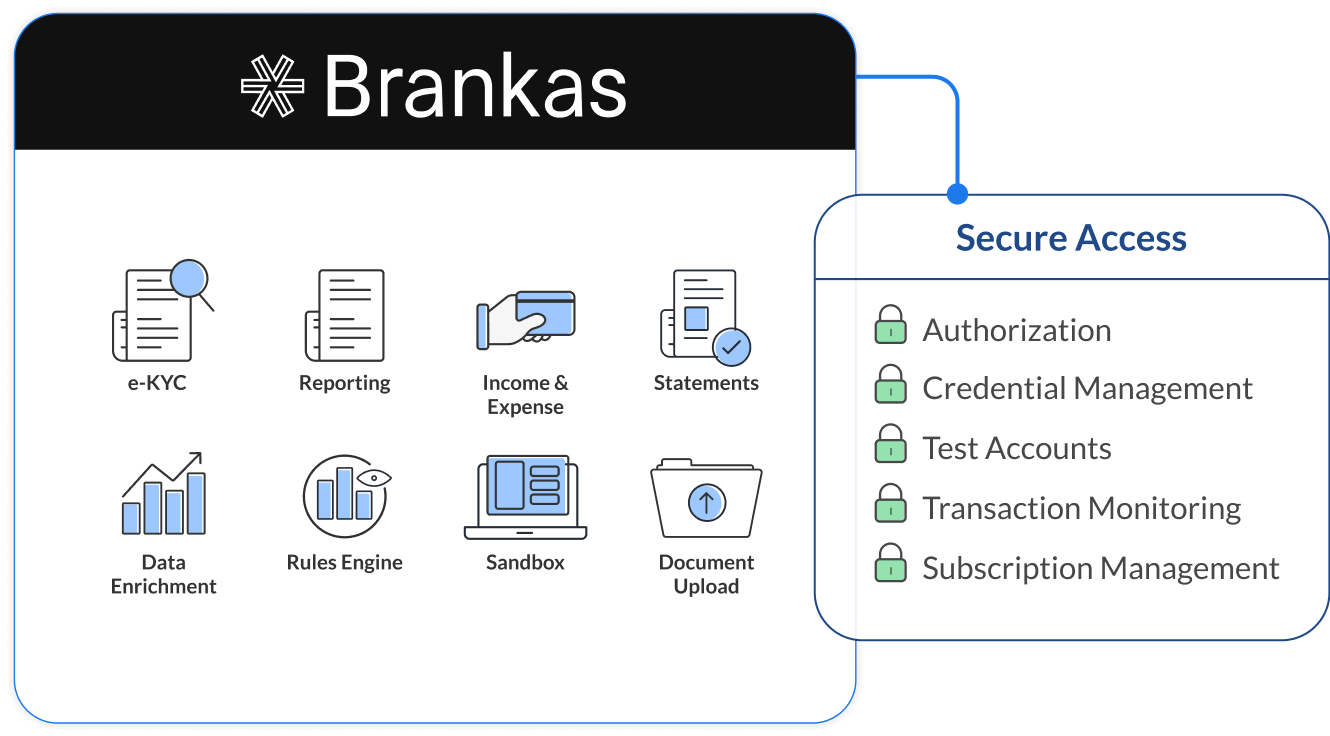

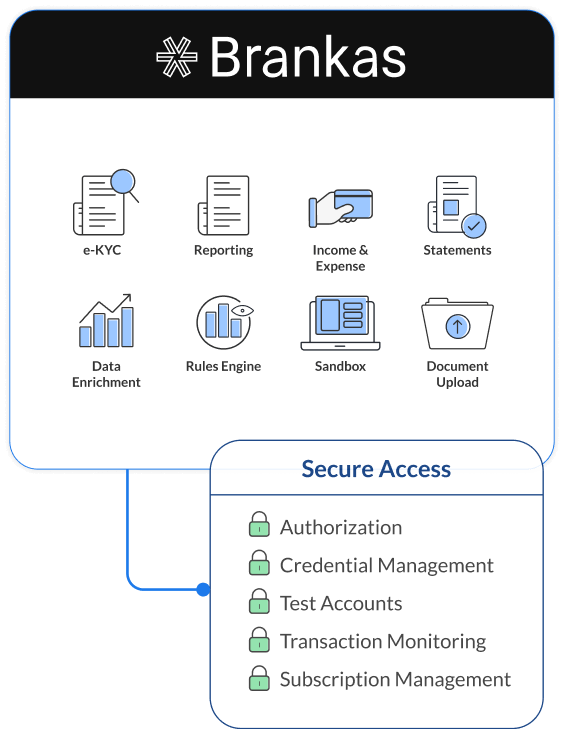

Not your average API gateway. Get access to all the financial APIs you need.

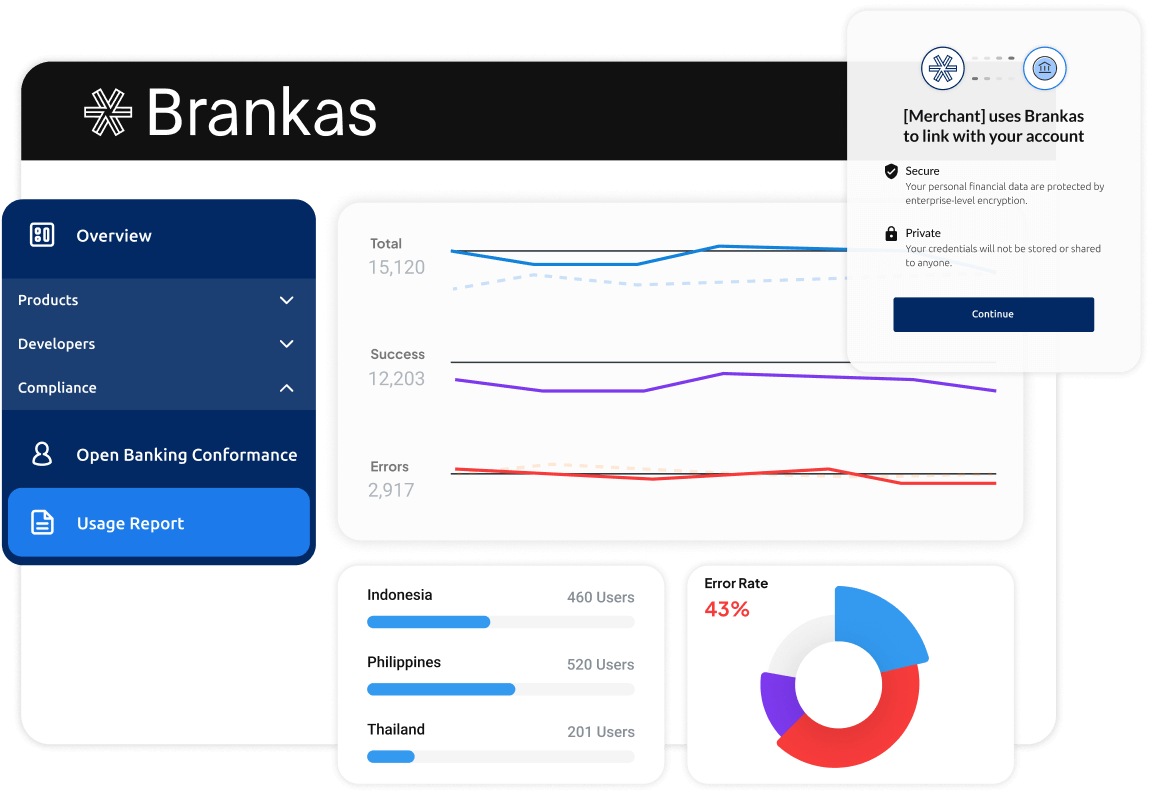

Whether it's SAMA Compliance for KSA or meeting global standards, Brankas ensures regulatory compliance across all jurisdictions.

No access unless necessary requirements are met.

Work with a certified implementation team you can trust.

Out-of-the-box APIs that generate revenue.

Not your average API gateway. Get access to all the financial APIs you need.

Build for any compliance standard, globally.

Whether it's SAMA Compliance for KSA or meeting global standards, Brankas ensures regulatory compliance across all jurisdictions.

Third-party management that’s painless.

No access unless necessary requirements are met.

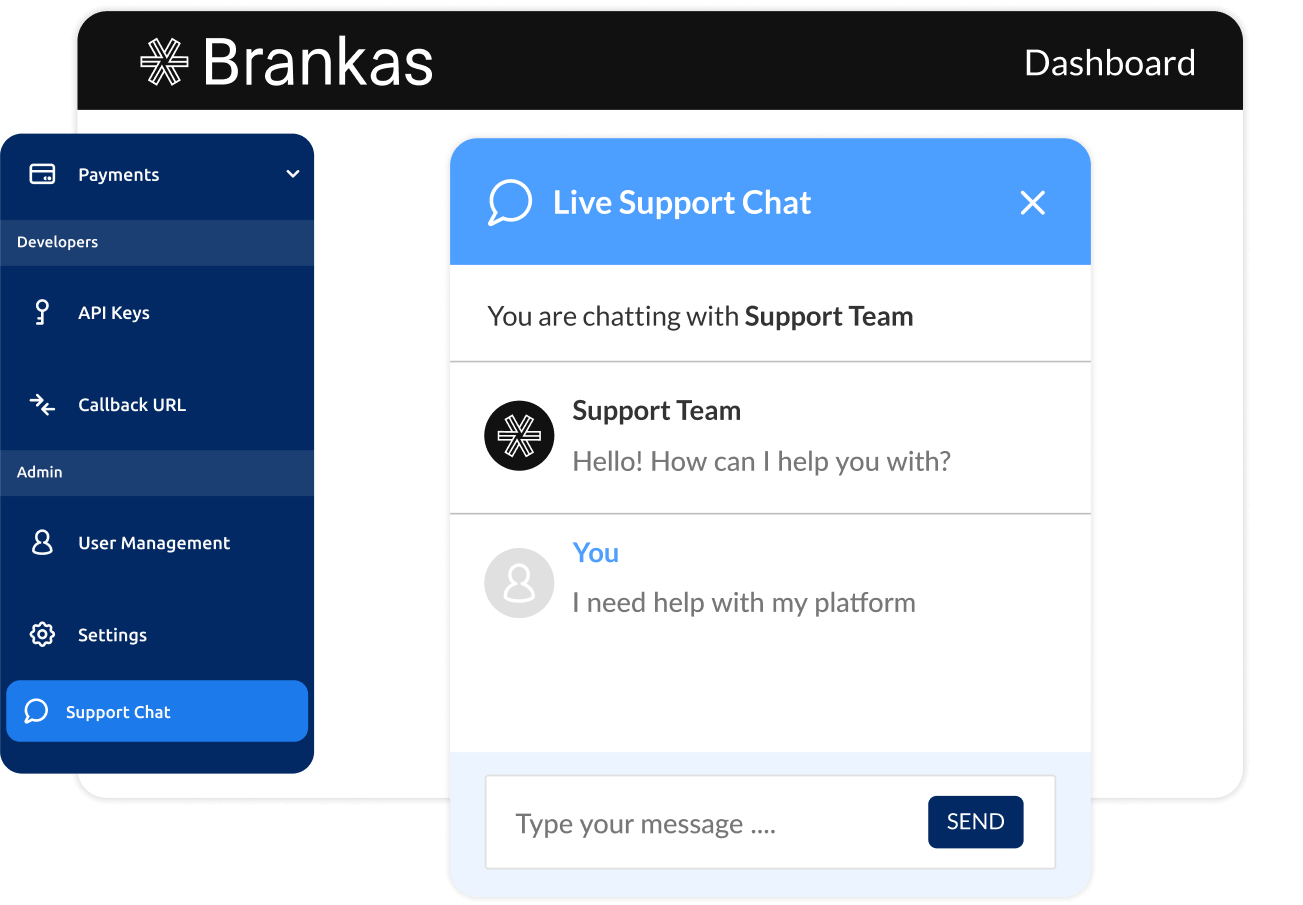

Managed services when you need guided implementation.

Work with a certified implementation team you can trust.

Hear it best from our clients.

Learn how you can accelerate your business with Open Finance.

Our vision is to empower our clients to deliver relevant and customer-centric products that positively impact the lives of customers, and we are proud to partner with a well-established open finance vendor like Brankas to help us achieve our goal.

Samer Soliman, Chief Executive Officer of Arab Financial Services (AFS)

Connect with us to scope out your open banking deployment.

Learn how you can accelerate your business with Open Finance.

Ever wonder how open banking generates more business?

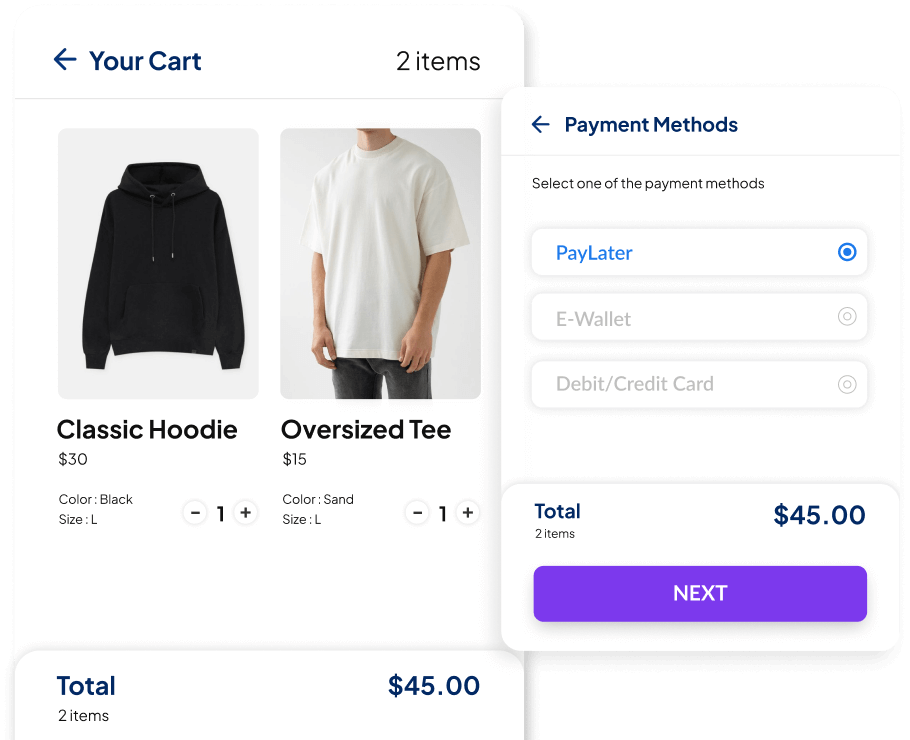

We make it easy for you to help your partners build BaaS products like BNPL and virtual credit cards. Use the out-of-the-box open API monetization templates and the billing portal.

Brankas is ISO 27001 certified and undergoes regular audits by financial regulators, ensuring a high standard of security in all operations.

Learn More

We help you save time and money.

We offer expert implementation either by our professional team or through an approved systems integration partner, ensuring quality and efficiency.

Organizations that build with Brankas consistently report higher satisfaction.

Fast deployment

Fast deployment

- Hybrid, cloud, or on-prem API infrastructure

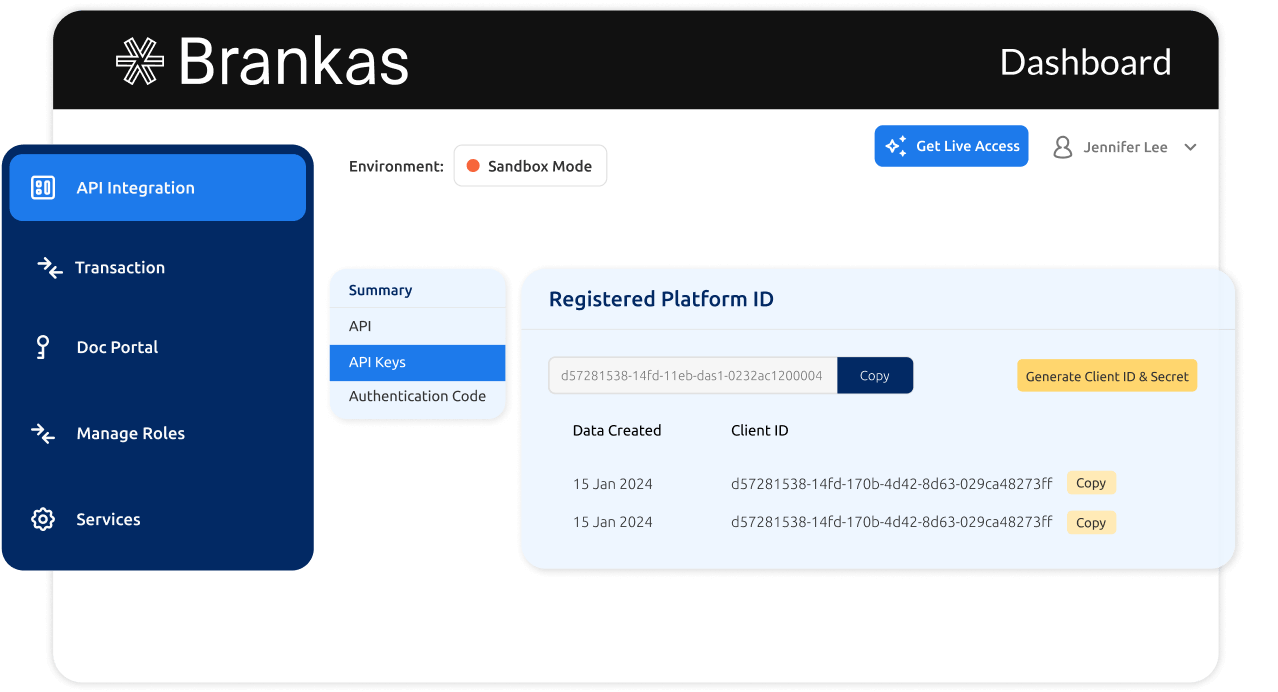

- Banking-as-a-Service developer portal

- Third party partner portal

- ISO 27001, PCI DSS, and geo-specific compliance reports

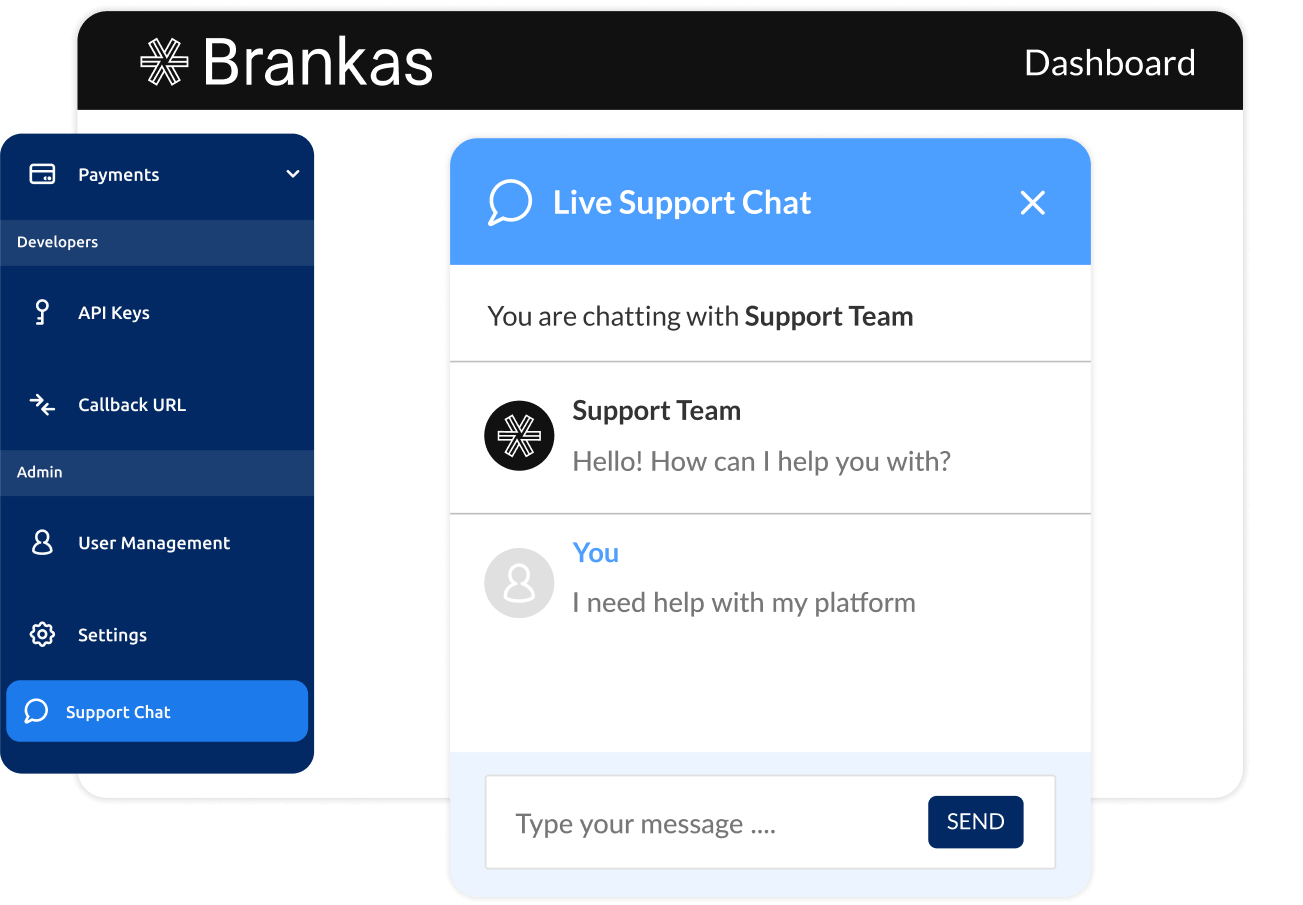

- 1-to-1 post-sales support

Easy integration

Easy integration

- API infrastructure

- Multi-year consulting

- Widgets

- Helpdesk support

- API infrastructure

- Managed services subscription

- API infrastructure

- Compliance Platform

Fast deployment

Fast deployment

- Hybrid, cloud, or on-prem API infrastructure

- Banking-as-a-Service developer portal

- Third party partner portal

- ISO 27001, PCI DSS, and geo-specific compliance reports

- 1-to-1 post-sales support

Easy integration

Easy integration

- API infrastructure

- Multi-year consulting

- Widgets

- Helpdesk support

- API infrastructure

- Managed services subscription

- API infrastructure

- Compliance Platform