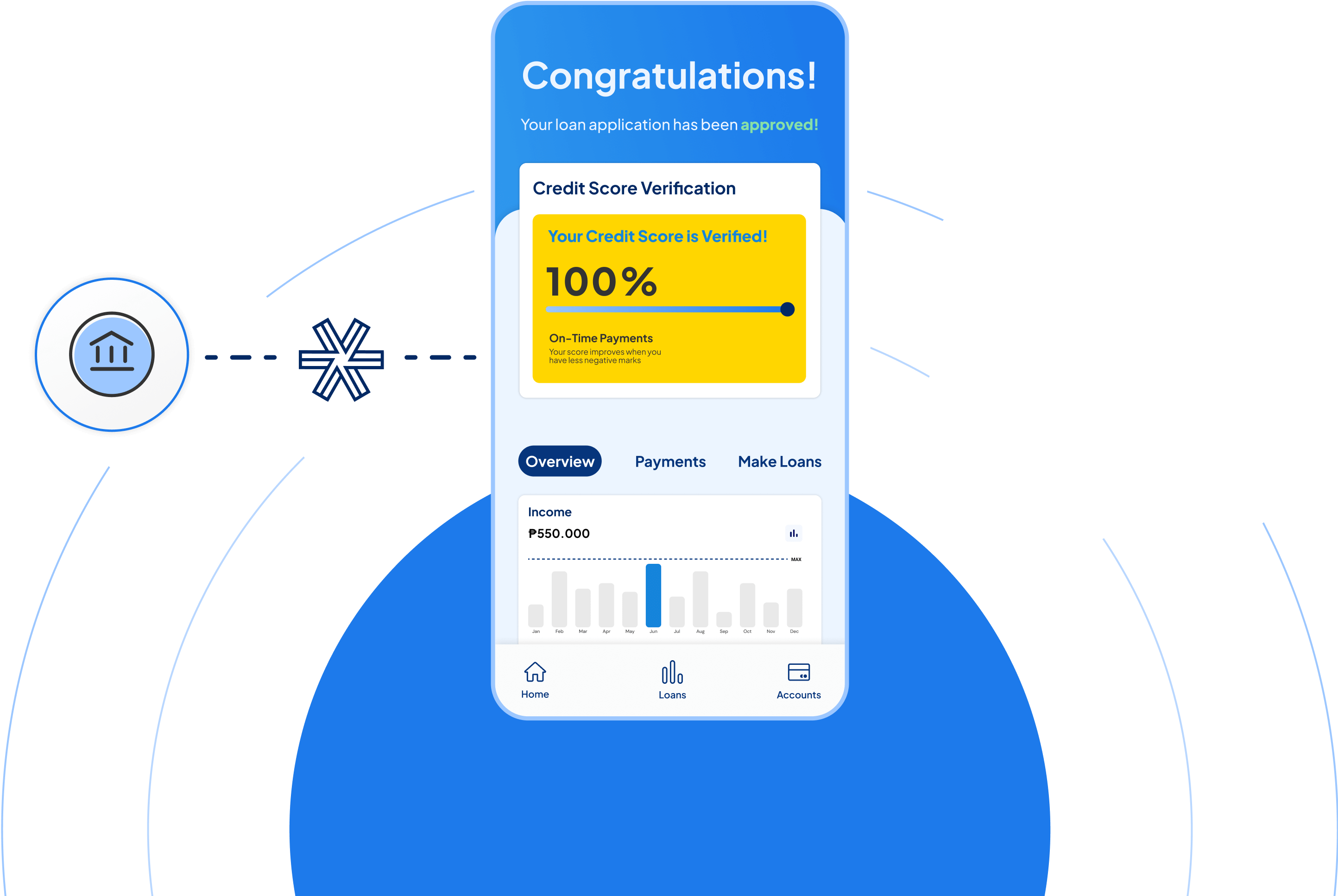

Trim down your loan application process from 7 days to 10 minutes with Brankas APIs.

We trim down the process and help

reduce

operational costs by using existing financial data.

Helping businesses provide a faster, better, and easier way to onboard and retain customers.

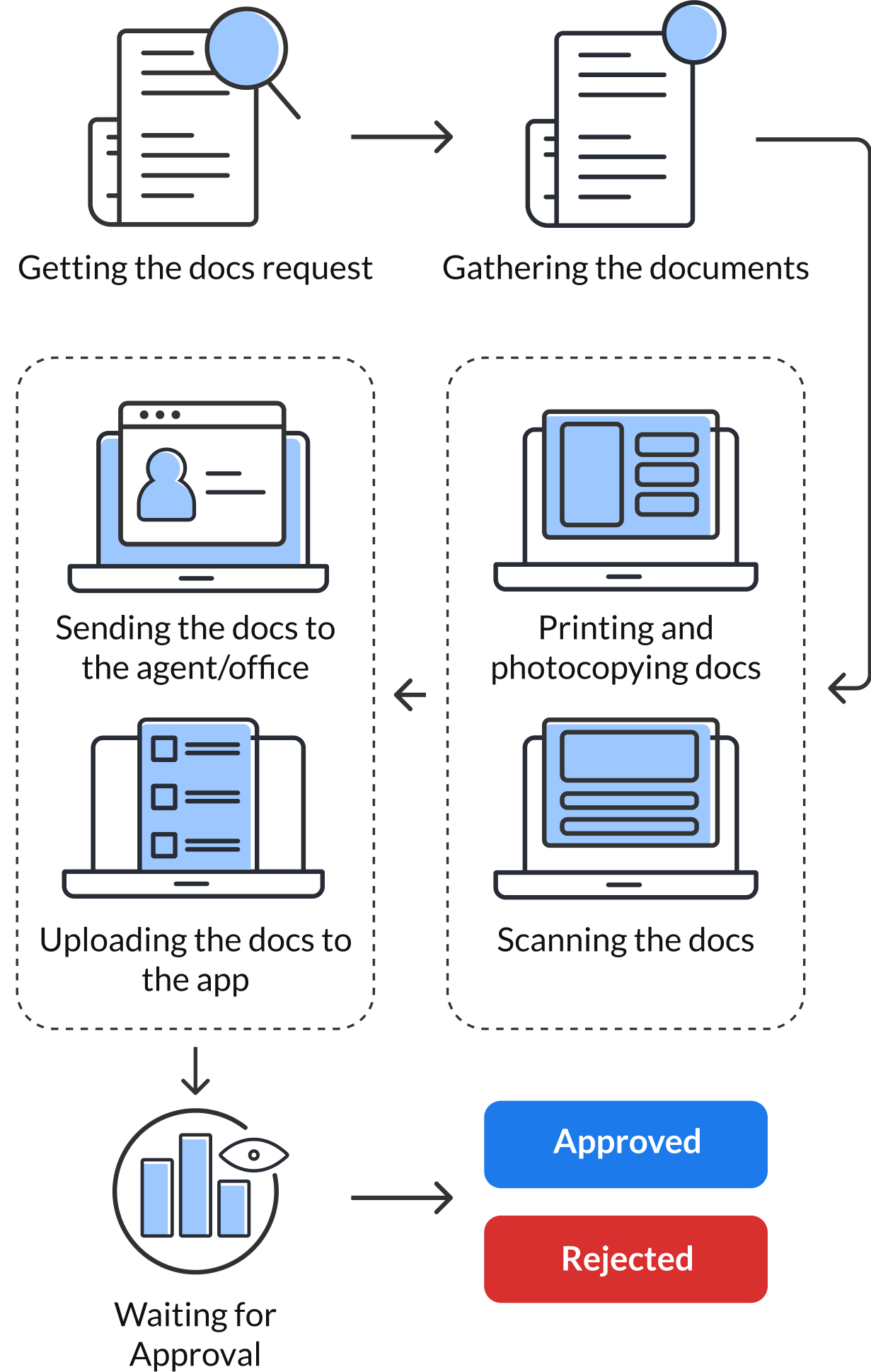

Typical User Journey

Averaging 4-7 days

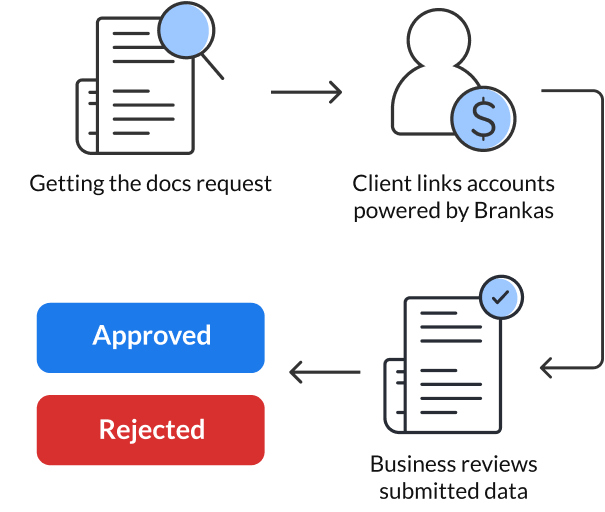

Sample User Journey with Brankas Data APIs

Averaging 5-10 minutes

Remove the need for manual KYC data collection and processing.

Boost conversions and repayments with data segmentation.

Verify credit history and personal identification within minutes.

Disburse loan proceeds to your borrowers with minimal hassle.

Provide personalized financial tips, insights, and recommendations.

Use financial data to give your users a better experience, wherever they are.

Start scaling your lending company with Brankas APIs, today.

Brankas is the pioneer in open finance and banking APIs, enabling lending and financial businesses across the globe to provide a faster, better service to their customers.

We empower users to effortlessly connect their financial accounts to share their data.

All-in-one data linking for a smooth user journey, faster onboarding, and better application experience.

Straightforward, easy, and efficient is how we integrate bank data.

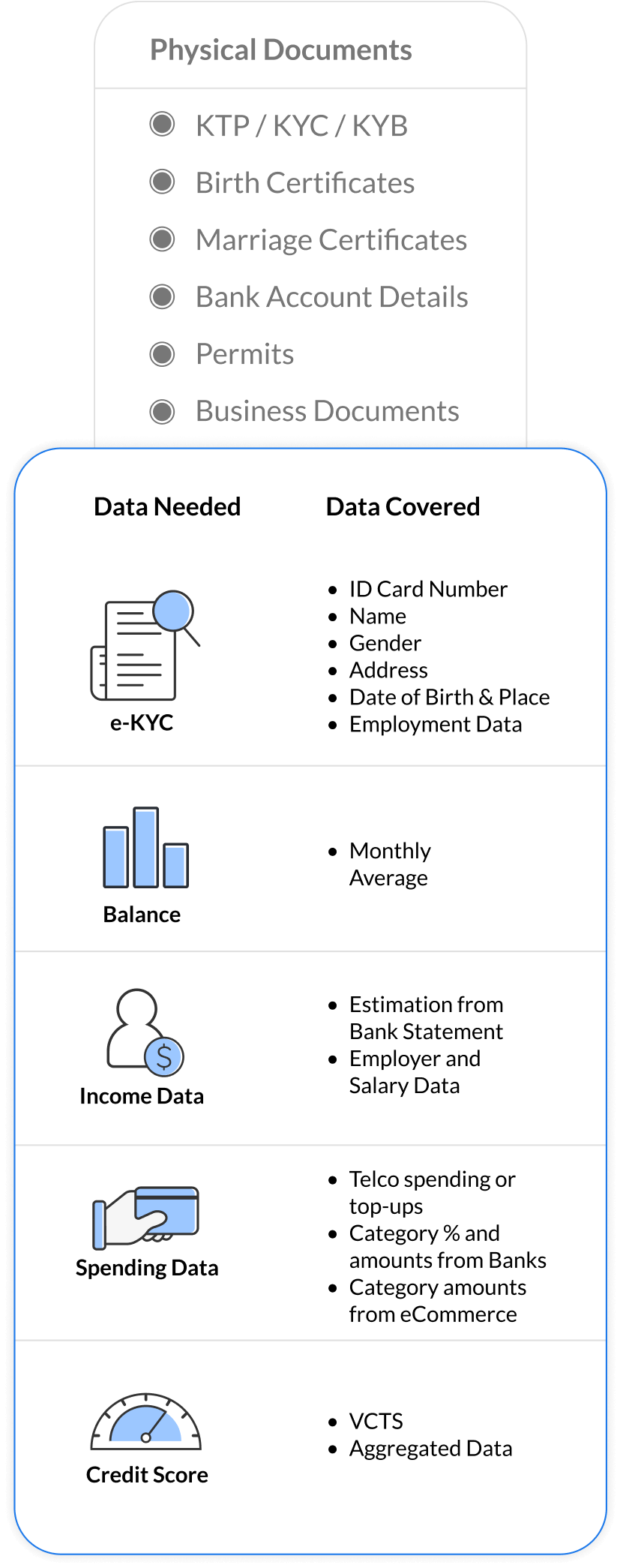

Allow users to move from submitting a lot of physical documents to connecting their accounts that provide the same information!

How Businesses & Lenders

Can Empower Users to Connect their Existing Accounts to Share Financial Data.

Here's what the data sharing process for multiple institutions looks like for users: straightforward, easy, and efficient for both users and merchants.

User gives consent to share data to the organization

User inputs their ID and phone number

User chooses which institutions to connect

User logs-in to the institutions online portal

User gets notified if the data sharing was successful

User can link more accounts via the dropdowns

Brankas partners with the following to provide robust APIs to lending companies:

Coming Soon

...and many more coming soon!

Get more from Brankas

Explore other products and services by Brankas