Know Your Customer is a process companies do to verify a client’s identity to avoid fraud and other crimes. While this was traditionally accomplished in person, the digital revolution has brought about eKYC, which uses financial data APIs to make the process faster and more effective.

Let’s discuss what eKYC is, how it differs from KYC, its process, and its benefits.

What is eKYC?

eKYC or “Electronic Know Your Customer” refers to the digitalized process of verifying a client’s identity prior to account opening or the start of a business relationship. eKYC serves the same purpose as a traditional KYC protocols – to mitigate fraud, theft, and other finance-related crimes.

If you are aware what KYC is, eKYC revolves around the same fundamental processes – they both require collection of information, validation of data and documents, and assessment of client’s risk.

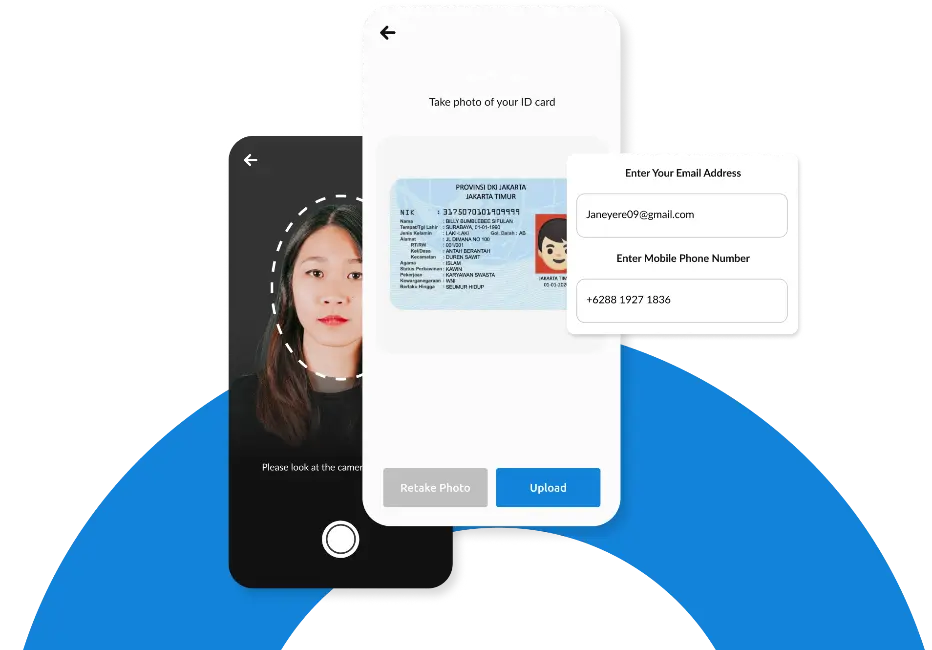

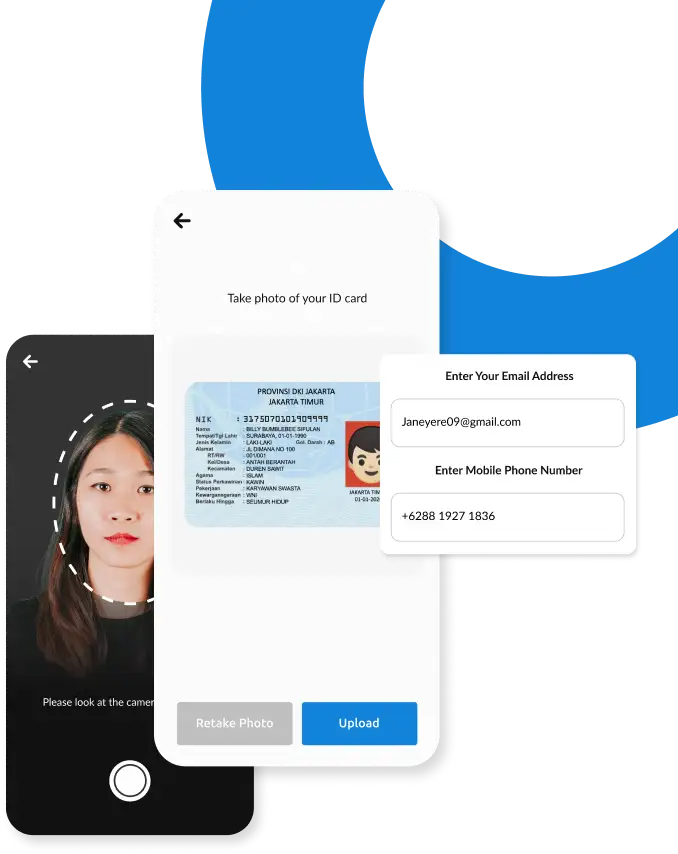

However, with electronic KYC, the KYC process can be done online. Customers can fill out e-forms, upload copies of their documents, and provide biometric data to a website or application, where it can then be validated and assessed for risk. This removes the cumbersome processes of having to visit a physical location for customers and manually verifying data and assessing risk for business entities.

The eKYC Process

eKYC means it uses technology throughout the process. The process differs for every organization, but more or less involves these steps:

-

User Registration

The process begins with the user entering their personal information on the company’s platform.

-

Providing Documents

The user uploads copies of their KYC documents, which includes proof of identity (i.e., passport and government IDs), proof of address (i.e., utility bills containing the client’s full address), and proof of income (i.e., pay slips and bank statements).

-

Biometric Verification

The user may be asked to upload ID pictures, take pictures or videos, or upload a fingerprint. The biometric data will then be used as cross-reference to confirm that the client’s facial features match those in their IDs. It will also be stored in the system for facial biometric identification.

-

Document Verification

The company validates the authenticity of the client’s KYC documents to confirm that they are who they claim to be. Document verification typically involves checking if the documents are legitimate and cross-referencing these data with other sources using APIs for digital banking.

-

Multi-Factor Authentication

The user is asked to verify account creation (and then transactions) using another gadget. This helps establish their digital breadcrumbs which helps reduce the risk of identity fraud.

-

Ongoing Monitoring

Once the onboarding process is completed, for example once the client has created an account with a bank, the organization saves the data in their system and proceeds with customer due diligence procedures keeping ever client under appropriate levels of monitoring

Benefits of eKYC Verification

eKYC addresses the different pain points of KYC protocols, offering the following benefits:

Streamlined Processes

eKYC simplifies the KYC process both on the end of the customers and organizations. It allows users to upload the required documentation. Meanwhile, organizations can automate the verification and assessment processes to arrive at decisions faster without compromising security. So, it’s not just customers but also organizations that save time with eKYC.

Improved Accuracy

APIs minimize human intervention, and therefore, errors. This ensures that all data is verified against multiple databases and analyzed accurately, thus enhancing the accuracy of KYC checks.

Reduced Workload

Know Your Customer processes are meticulous and time-consuming for employees of finance institutions. The integration of technology like GoPay Data and Merchant Link helps relieve some of the employees’ workload, such as handling large volumes of data for CDD.

Lower Operational Costs

KYC verification can be costly for many businesses, especially as their customer base grows. With eKYC, organizations can keep their costs manageable. By employing automation technology, organizations can reduce onboarding delays and human errors, as well as keep up with the demands of their growing client base.

Enhanced Security

eKYC encourages a proactive approach to fraud management, allowing them to detect fraudulent or illegal activities early. But the process itself also serves as a deterrent to financial crimes, thus improving security for the organization and its customers. By adding layers of security and improving the accuracy of KYC checks, eKYC makes it riskier to commit financial crimes.

Scalability

As a business grows, the burden of KYC verification grows, straining its operational capacity and accuracy. Automation technology allows financial institutions to scale their operations to meet the demands of their client base.

APIs for lending can handle and process large volumes of data faster so you can continue to provide fast KYC checks and loan approvals, as well as monitor every client’s behavior.

Implementing eKYC in the Philippines

As more Filipinos become interested in using digital banking services, the need to establish a fortified financial ecosystem becomes even more urgent. Electronic Know Your Customer presents numerous opportunities to strengthen security in the country. It can expedite the verification process, improve accuracy, and lower operational costs for financial institutions while reducing the risk of fraud and making digital banking more accessible.

However, it’s also important to note the potential risks that come with eKYC, such as data privacy concerns, potential cybersecurity threats, and the need for robust regulatory frameworks to ensure data protection and compliance.

The successful implementation of eKYC in the Philippines requires balancing opportunities and risks through trusted and strong technological infrastructure and protocols.

Adopt eKYC with Brankas

eKYC offers a lot of benefits for financial institutions in the Philippines and around the world. We hope that understanding eKYC’s meaning, processes, and benefits can help financial institutions appreciate how they can protect themselves and their customers from the threat of fraud and other financial crimes.